Here's some of our frequently asked questions

What do I do if my debts feel unmanageable?

What can I do if I am struggling with or unable to pay my loan or lease payments?

What should I do if I’m concerned my home may be repossessed?

I’m worried about the amount I’m paying for my ‘rent-to-buy’ agreement. What should I do?

I’m worried about my credit history

I’m late making payments on my credit card, car loan or other loan

I’m concerned about my phone or utilities payments

What is bankruptcy?

I’m having trouble returning or exchanging an item. Can you help?

Enquire about consumer credit support

Contact Information

The Consumer Credit Law Centre of South Australia

43 Franklin St, Adelaide SA 5000, Australia

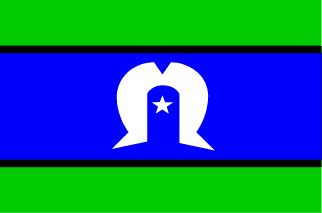

Kaurna Country

GPO Box 943, Adelaide, 5001

Upon request, we may also be able to offer appointments at our Christies Beach office.

The Consumer Credit Law Centre of South Australia is funded by the South Australian Department of Human Services